Since its launch in August 2018, Opay has rapidly risen to prominence as one of Nigeria’s most popular fintech apps, boasting over 35 million users. Its impact on the fintech landscape is undeniable.

One standout feature of the Opay mobile banking app is the ‘Lock Funds’ option in Fixed Deposit Savings. This unique feature allows you to securely lock your funds for a predetermined period while earning interest. In this guide, we’ll walk you through how to make the most of this feature quickly and effectively. Let’s get started.

How Does Opay Fixed Deposit Savings Work?

As stated, OPay Fixed Deposit Savings is a financial product from Opay that allows you to save money for a fixed period of time in exchange for a higher interest rate than you would earn on a regular savings account. This is a good option for those who want to save money for a specific goal, such as getting a new phone or a new car. It is also a good option for people who are looking for a higher interest rate on their savings.

With the Opay Fixed Deposit, you have two options: locked and unlocked. If you pick the locked option, your money is kept for a set time (days, weeks, or months) and will only be paid to you on the payback date you choose. With the unlocked option, however, you can get your money back on or before the payback date.

So basically, the difference between the two is that while you can choose to cancel your savings and withdraw your money from the Unlocked deposit at any time, the Locked option does not give you such a chance. No matter how urgent you suddenly need the money, with the Locked fixed deposit, you are only getting paid on your exact payday.

ALSO SEE: How To Keep Your Opay Account Secured At Times

Fix Your Money On Opay In Easy Steps

Now without beating around the bush, let’s jump straight into the process of securing our funds on the Opay digital wallet:

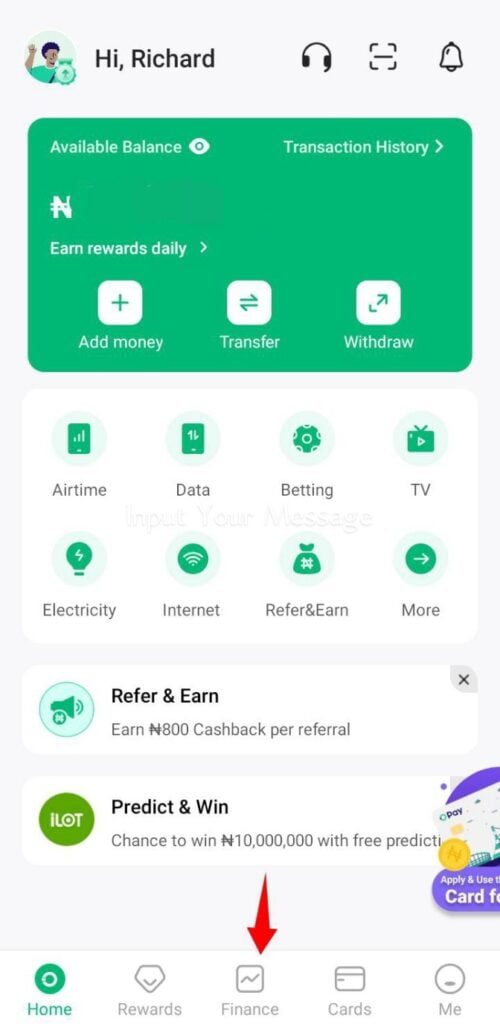

1. Launch your Opay mobile app whether on iPhone or Android, and sign in if you are not already.

2. From the home dashboard, tap on “Finance”. Finance is the third and middle button at the bottom menu on the homepage.

3. Under the “Savings” tab, tap on “Fixed”

4. Next, tap on “Locked funds” or “Create a plan”.

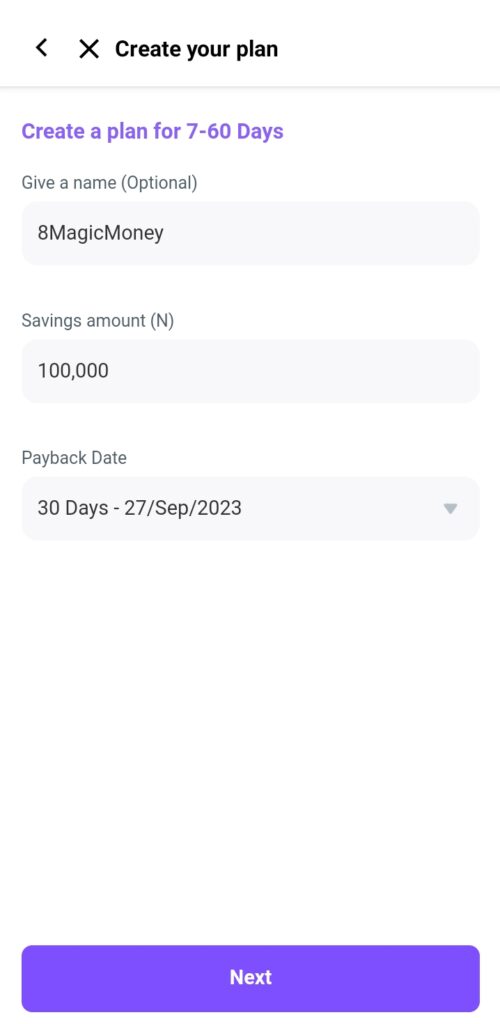

5. Select your investment duration (the number of days you want to keep the money saved). You can select between 7 to 1000 days. The higher the duration, the higher the interest rate.

6. On the next page, give your plan a name if you wish. Enter the amount you want to lock, and select the payback date. The payback date is the date you are authorizing Opay to release the funds back to you, to your Owealth balance.

7. Now to lock your your money on the Opay app, toggle the lock button (see screenshot). When you do this, you will be reminded that funds locked away cannot be redeemed in advance. Tap on “OK” if you agree, and tap on the “Payment” button underneath.

8. If the money on your Opay balance is enough to pay for the locked funds, it will be debited and locked. If it is not up to the requested lock amount, you will be required to add more funds. You can add funds either via your debit card or bank. However, to make things easier, just transfer enough funds to your Opay account that’s enough to pay for the lock before starting the process.

9. After getting the required amount needed to be locked away, tap on the payment button, and you are done.

10. Your locked money will be used for investments by Opay and will be returned to you with interest on the agreed date.

READ: PalmPay Cashbox | Auto-Savings | Withdrawal

Opay Fixed Deposit Interest Rate

If your savings amount to N300,000 or less, you will receive an annual interest rate of 15-18%. For savings exceeding N300,000, you will earn interest at a rate of 15-18% on the initial N300,000, and 6-9% on the remaining balance. The longer the duration of the savings, the higher the interest rate you will earn.

The table below explains it better:

| Duration (Days) | Balance ≤ N300k | Balance > N300k |

|---|---|---|

| 7-60 | 15% | Up to 18% on the first N300k and up to 9% on the remaining balance |

| 61-180 | 16% | Up to 18% on the first N300k and up to 9% on the remaining balance |

| 181-364 | 17% | Up to 18% on the first N300k and up to 9% on the remaining balance |

| 365-1000 | 18% | Up to 18% on the first N300k and up to 9% on the remaining balance |

Calculating,

For balances of N300,000 and below:

You will earn up to 18% interest per annum. This means that if you invest N300,000 in a 365-day fixed deposit, you could earn up to N54,000 interest.

For balances of over N300,000:

You will earn up to 18% interest on the first N300,000 and up to 9% interest on the remaining balance. This means that if you invest N500,000 in a 365-day fixed deposit, you would earn up to N54,000 interest on the first N300,000 and N18,000 interest on the remaining N200,000, for a total of N72,000 interest. We hope this is clear.

How Do I Unlock My Money on OPay?

You cannot unlock your money on Opay from your Fixed deposit if you toggled on the ‘lock’ during the setup process. But if you choose the Unlock mode, you can withdraw your money at any time, even before the due date, however, there will be penalties; all the accrued interests will be lost if you choose to withdraw your unlocked funds before the payback date.

Conclusion

In conclusion, the Opay Fixed Deposit Savings is a great way to save money and earn interest. The process of locking your funds is simple, and you can do it all from your Opay mobile app. Just be sure to choose the locked option if you want to keep your money safe and earn the highest interest rate. However, choose the unlock option if you are not very sure you won’t need the money before the payback date.

Let us know in the comments if the process worked for you. And if you are stuck somewhere or have any questions, also let us know.

READ:

Best Nigeria Online Banking Apps & Wallets Without BVN

How To Lock Money On PalmPay [Easy-to-Follow Guide]

Please can I add more funds to my locked funds?

Hi OJO, please note that once you lock your funds, you cannot access that funds until the maturity date.

So if you wish to lock more funds, you will need to create a new savings plan.